The hidden junk fee the Biden administration should take on next

The Biden administration has smartly made tackling junk fees – from banks to hotels to live entertainment to rental housing to cable – a priority. Last fall, standing in the…

The Biden administration has smartly made tackling junk fees – from banks to hotels to live entertainment to rental housing to cable – a priority. Last fall, standing in the…

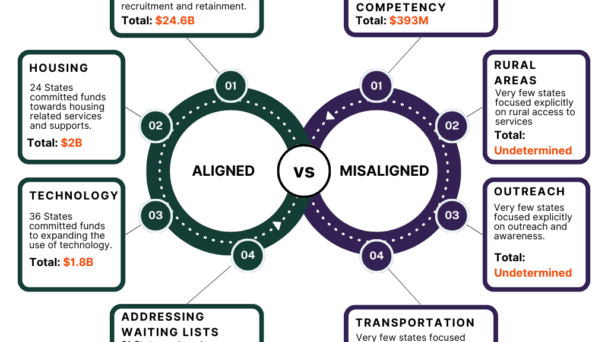

Did ARPA Investments in Home and Community-Based Services Reach Those Who Needed it Most?

Did ARPA Investments in Home and Community-Based Services Reach Those Who Needed it Most?

Every year, millions of people choose to live independently and receive care services in their homes and communities; opting for this over moving to a care facility or institution. For…

Student loan forgiveness is good – but it’s not enough. We need action on medical debt.

Student loan forgiveness is good – but it’s not enough. We need action on medical debt.

Last month, the Biden administration announced that it will forgive $1.2 billion in student loan debt for over 150,000 borrowers – an important and necessary move to provide relief for…

When this year’s Open Enrollment period came to a close in January, we celebrated along with the Biden administration that more people than ever enrolled in ACA Marketplace health insurance…

Restuccia Health Justice Fellowship Offers Refuge and Community to Advocacy Leaders

Restuccia Health Justice Fellowship Offers Refuge and Community to Advocacy Leaders

Apply to join the 2024-2025 cohort by March 25 In the fight for health justice, we are up against a complex system of corporate interests. We need an even stronger,…

The Value of Partnership: Celebrating Progress in the Movement for Health Justice, Year in Review

The Value of Partnership: Celebrating Progress in the Movement for Health Justice, Year in Review

From the start, Community Catalyst has understood the critical role and value of partnership. We strongly believe that it is only by working and building power together that we can…

Addressing Medical Debt: A Year of Partnership and Progress

Addressing Medical Debt: A Year of Partnership and Progress

I live with an 8th grader who is currently taking advanced math. While that may read like a cringey parental humble brag, the context is that I am at a…

It is personally difficult for me to believe that the American Rescue Plan Act (ARPA) – President Biden’s trillion-dollar spending package to alleviate some of the chaos COVID-19 inflicted on…

Lessons in Community Engagement: Georgia Site Visits Provide Windows into Rural Outreach and Language Justice in Action

Lessons in Community Engagement: Georgia Site Visits Provide Windows into Rural Outreach and Language Justice in Action

Last month, staff members from our Medical Debt team had the privilege of visiting two of our state partners in Georgia. SOWEGA Rising and Georgia Watch are both part of…

Serving the Health Needs of Elder LGBTQ+ Adults in Puerto Rico

Serving the Health Needs of Elder LGBTQ+ Adults in Puerto Rico

As team members of Community Catalyst’s Vaccine Equity and Access Program (VEAP), this fall we traveled to Puerto Rico to visit Waves Ahead, a community-based partner and the only LGBTQ+…

Let’s unite for health justice. Together, we’ll work toward a more just and equitable health system.

Take Action